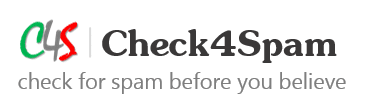

[SPAM] Nine Banks Will Be Closed Permanently By Reserve Bank Of India

The message claiming that nine banks will be closed permanently by Reserve bank of India, circulating on social media Since 2017 is false. Please read more about it in verification section of this article.

Post Information:

Below post has been circulating on social media.

“Nine banks will be closed permanently by Reserve bank of India. If anybody having transactions in it please kindly withdraw it. The names of the bank’s are Corporation Bank, UCO Bank, IDBI, Bank of Maharashtra, Andhra Bank, Indian Overseas Bank, Central Bank of India, Dena Bank and United Bank of India. 9 banks are going to be close if u guys have any account in this banks so please immediately safe ur cash and forward this msg to all. Order by supreme Court (Sic).”

Verification: No, RBI is not closing any bank

The rumors about RBI are circulating since 2017. The information is not true. RBI clarified the false information on its twitter account recently and at Press Release: 2016-2017/3288 earlier. Please check the link below to the facts:

Reports appearing in some sections of social media about RBI closing down certain commercial banks are false.

— ReserveBankOfIndia (@RBI) September 25, 2019

RBI Clarification on Banks under Prompt Corrective Action: Read more

Date : Jun 05, 2017

RBI Clarification on Banks under Prompt Corrective Action

The Reserve Bank of India has come across some misinformed communication circulating in some section of media including social media, about the Prompt Corrective Action (PCA) framework.The Reserve Bank has clarified that the PCA framework is not intended to constrain normal operations of the banks for the general public.

It is further clarified that the Reserve Bank, under its supervisory framework, uses various measures/tools to maintain sound financial health of banks. PCA framework is one of such supervisory tools, which involves monitoring of certain performance indicators of the banks as an early warning exercise and is initiated once such thresholds as relating to capital, asset quality etc. are breached. Its objective is to facilitate the banks to take corrective measures including those prescribed by the Reserve Bank, in a timely manner, in order to restore their financial health. The framework also provides an opportunity to the Reserve Bank to pay focused attention on such banks by engaging with the management more closely in those areas. The PCA framework is, thus, intended to encourage banks to eschew certain riskier activities and focus on conserving capital so that their balance sheets can become stronger.

The Reserve Bank has emphasized that the PCA framework has been in operation since December 2002 and the guidelines issued on April 13, 2017 is only a revised version of the earlier framework.

Ajit Prasad

Assistant AdviserPress Release: 2016-2017/3288

Many such information circulate on social media. Whenever the information is related to the government or public or national sector, it is reflected on its related website. One must always check on official website of the same to know the fact. Before believing and forwarding such messages, always confirm if it is true. Sharing false information is not we want. It is important to know what we share. Please check on any fact check site before you pass it on further.

We ensure that you are updated with the facts. Please Check4spam before forwarding and believing any doubtful image, message or video. Be cautious, be safe.

Find all fact checking articles about news using Nokiye.com

Nine Banks Will Be Closed Permanently By Reserve Bank Of India I Nokiye

Post Date: 11 Oct 2019

Post ID: #73958