[SPAM] Split Your Bill While Shopping to Save GST

It’s a false information. GST is on individual item prices NOT on your total bill. Please find more details at the verification section of this article.

Post Information:

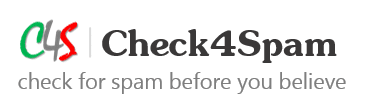

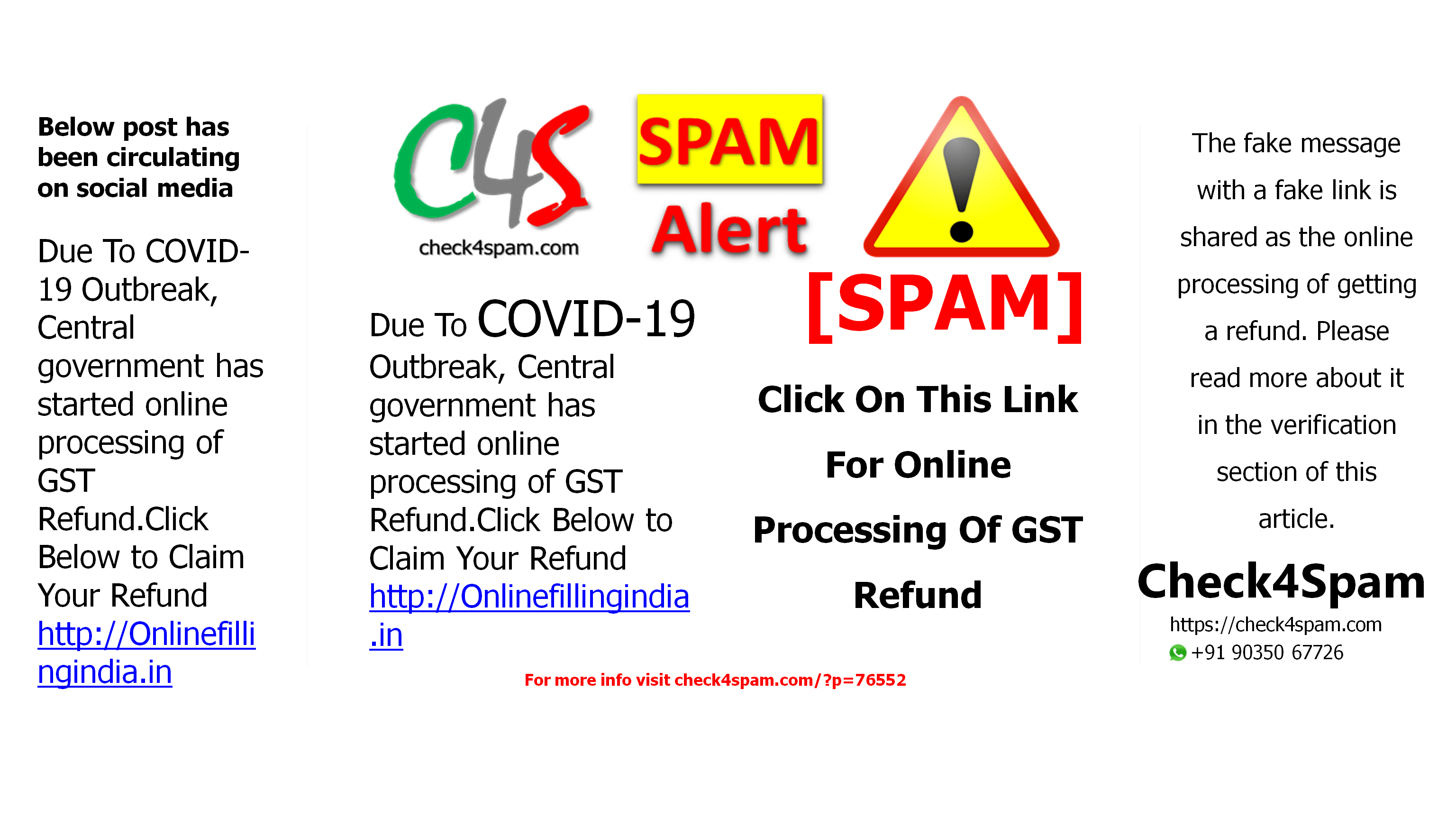

Below post has been circulating on social media

D-mart se shopping karte waqt dhyaan rakhe ke bill alag alag bane kyuki 1000 ki Bill ke upar GST ka slab aise hai –

Upto 1000 0% GST

1000 to 1500 2.5% GST

1500 to 2500 6% GST

2500 to 4500 18% GSTPls share with all your near and dear ones ??

Other similar post…

While shopping in Big Bazaar, GVK One, D-Mart, Spencers, Inorbit, Forum Sujana Mall, More, and other shopping malls pay attention to your billing…

Get every bill separate for every Rs. 1000/- because the GST slab breakdown is as follows:

0 to 1000 0% GST

1000 to 1500 2.5% GST

1500 to 2500 6% GST

2500 to 4500 18% GST

Please share with all your friends and family…

Other similar post…

Koi bhi mall ya shopping center ya store se shopping karte waqt dhyaan rakhe ke bill 1000 ka alag alag banana. kyuki 1000 ki Bill tak GST nahi hae, iske upar GST ka slab aise hai –

Upto 1000 0% GST

1000 to 1500 2.5% GST

1500 to 2500 6% GST

2500 to 4500 18% GSTPls share with all your near and dear ones ??

Verification:

This is not true. The slabs are on individual item prices below 1000 not on total bill. A quick info given below.

No tax(0%)

Goods

No tax will be imposed on items like Jute, fresh meat, fish chicken, eggs, milk, butter milk, curd, natural honey, fresh fruits and vegetables, flour, besan, bread, prasad, salt, bindi. Sindoor, stamps, judicial papers, printed books, newspapers, bangles, handloom, Bones and horn cores, bone grist, bone meal, etc.; hoof meal, horn meal, Cereal grains hulled, Palmyra jaggery, Salt – all types, Kajal, Children’s’ picture, drawing or colouring books, Human hair.

…

Services

Hotels and lodges with tariff below Rs 1,000, Grandfathering service has been exempted under GST. Rough precious and semi-precious stones will attract GST rate of 0.25 per cent.

…

Items such as fish fillet, Apparel below Rs 1000, packaged food items, footwear below Rs 500, cream, skimmed milk powder, branded paneer, frozen vegetables, coffee, tea, spices, pizza bread, rusk, sabudana, kerosene, coal, medicines, stent, lifeboats, Cashew nut, Cashew nut in shell, Raisin, Ice and snow, Bio gas, Insulin, Agarbatti, Kites, Postage or revenue stamps, stamp-post marks, first-day covers.

…

For more info please refer the link below:A quick guide to India GST rates in 2017

economictimes.com | updated: JUN 29, 2017

Post Date: 7th July 2017

Post ID: #68693

Thank You for visiting Check4Spam. Kindly leave a comment at this article if you like our service.