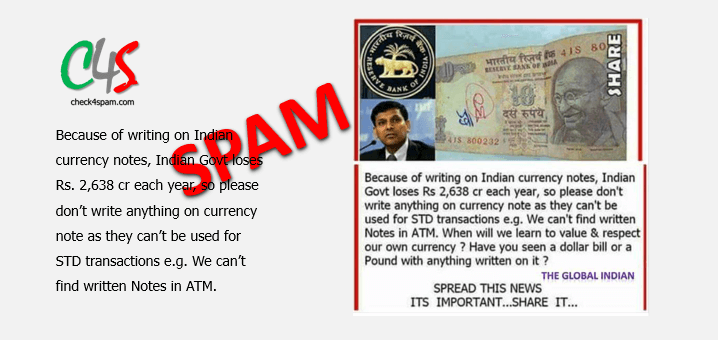

(SPAM) Banks will not accept if anything is written on the note

This is a fake news. Earlier last year RBI themselves had denied this rumour spreading on social media. Please check the verification section of this article for more details.

Post Information:

Below posts have been circulating on social media about banks not going to accept notes with anything written on it.

RBI in it’s latest circular RBI/2016-2017/123 DCM (Plg) No.1251/10.27.00/2016-17 has advised general public not to accept new currency note which has any text or sketch drawn on it.

This notification is as part of master circular published on 10th-Nov on withdrawal of Legal Tender of ₹500/- and ₹1000/- Bank Notes.In a separate press release RBI governor Mr Urjit Patel has clarified that as part of Government’s initiate to curb the use of black money, new notes of ₹ 500/- and ₹ 2000/- are printed with latest cutting edge technology which cannot be counterfeited and from Jan-2017 will be deposited and dispensed using new electronic machines across all banks in India. These German machines are imported as part of Modi’s digital India programme and will not be able to accept notes which have any text or sketch drawn on it. Reason for the same is in foreign countries, *p*eople do not write anything on the notes and hence their software are not designed to read anything apart from what’s printed on the note.

Pls forward this information to all your friends and *r*elatives (especially aged ones) to be extra careful while *a*ccepting these new notes to ensure that they do not accept currency notes which *h*ave anything written over it. *A*s such currency notes will no longer be accepted by banks or *R*BI.

More similar posts…

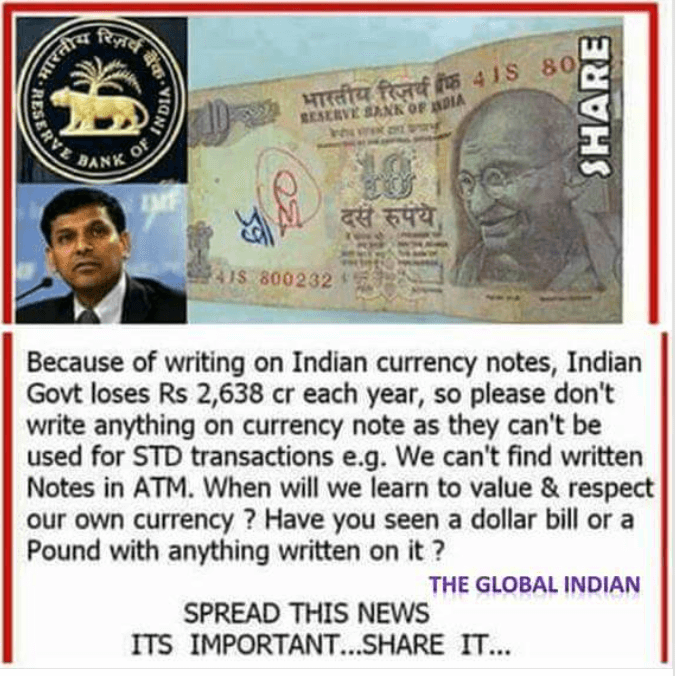

As per New Guidelines of Reserve Bank Of India, Writing any thing on new notes makes the note invalid & it will no more be a legal tender.

Just like US Dollars . If you write anything on US dollars it is not accepted by any one

Just forward to maximum people, so that the Indian public understands the importance of this message

More…

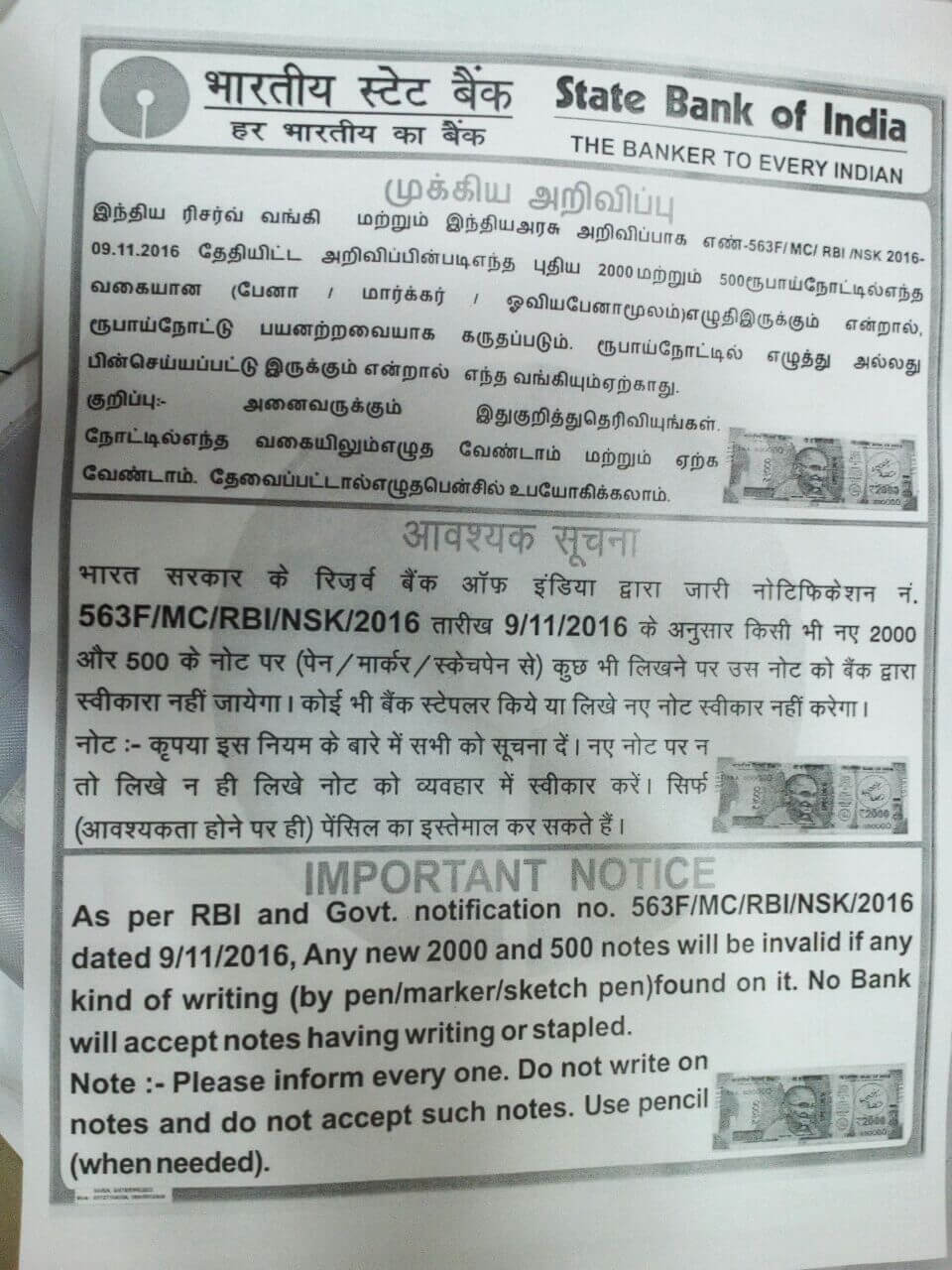

As per Govt notification no 563F/MC/RBI/NSK/2016 dated 9/11/2016, Any new 2000 and 500 notes will be invalid if any kind of writing found on it. No bank will accept notes with writing or staple pins on it. Please inform every one.

Verification:

(Updated 2nd Mar 2017) Mainstream media reports on this issue.

Got a currency with a scribble? No bank can refuse it, says RBI

https://www.pressreader.com/india/hindustan-times-delhi/20170228/282540133116795

(Further verification)

RBI notifications are available online. Please find them below. Also we have listed the links of the notifications dated 9th Nov 2016

https://www.rbi.org.in/Scripts/NotificationUser.aspx

Notifications from RBI on 9th November 2016

https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=10687&Mode=0

https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=10686&Mode=0

https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=10685&Mode=0

Earlier RBI themselves have issues a statement to denounce this rumour. Please find the RBI statement at their link below

https://www.rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=35717

Please note that RBI hopes people will NOT scribble of currency notes and they have been conducting awareness sessions periodically for this purpose. Please find more details about such an awareness session by RBI during 2013

Post Date: 17 Nov 2016

Post ID: 1157

Thank You for visiting Check4Spam. Please write a comment at this article if you like our service.