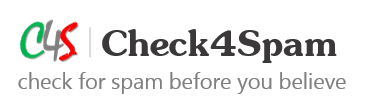

[SPAM] Proposed IT Slab Rates by CBDT For Financial Year (2017-18)

It’s an old news which started circulating during Jan 2017 just ahead of the February budget announcement for 2017 . Please find more details at the verification section of this article.

Post Information:

Below posts have been circulating on social media

Good news for income tax assesses

Proposed Income Tax slab rates by Central Board of Direct Taxes to be implemented from the next Financial Year (2017-18)

There will be 4 slabs unlike 3 at present

Up to 4,00,000. Nil

4,00,001 – 10,00,000.10%

10,00,001- 15,00,00015%

15,00,001-20,00,000 20%

20,00,001 & above. 30%

It is official information released this evening by CBDT.

Forwarded as received.

Verification:

As this post started circulating again even after the budgets were announced in February 2017, we will like to mention here that the budgets for 2017 were announced in February and the effective slabs and Income Tax rates can be found at the picture and link below.

Income Tax Slabs | Income Tax Rate for 2017-2018 and 2016-2017

Cleartax.in | Updated on

However during Dec 2016 there was a mainstream news about this possibility but it never happened.

Budget 2017 to focus on wealth redistribution, government may raise income tax exemption limit: CLSA

FE Online | Published: December 20, 2016 4:52 PM

Post Date: 3rd June 2017

Post ID: #68226

Thank You for visiting Check4Spam. Kindly leave a comment at this article if you like our service.